If your goal is the lowest price, then the best way to get discount car insurance rates in Corpus Christi is to compare quotes annually from companies in Texas. You can compare rates by completing these steps.

If your goal is the lowest price, then the best way to get discount car insurance rates in Corpus Christi is to compare quotes annually from companies in Texas. You can compare rates by completing these steps.

- Try to comprehend the different coverages in a policy and the things you can change to prevent rate increases. Many risk factors that cause high rates such as your driving record and a negative credit score can be rectified by making minor changes in your lifestyle. Keep reading for additional tips to get cheaper coverage and find possible discounts that are available.

- Compare rates from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only quote rates from a single company like GEICO and Allstate, while agents who are independent can quote rates for many different companies. Compare rates now

- Compare the new quotes to the price on your current policy and see if there is a cheaper rate in Corpus Christi. If you find a lower rate and change companies, ensure coverage does not lapse between policies.

The most important part of this process is to use similar coverage information on each quote request and and to get price estimates from as many companies as feasibly possible. This enables a fair price comparison and the best price quote selection.

A recent insurance study revealed that a large majority of insurance policyholders in Texas kept their coverage with the same insurance company for at least four years, and nearly half have never compared rates to find cheaper insurance. Consumers in the U.S. could save themselves about $850 a year, but they don’t understand how simple it is to compare other rate quotes.

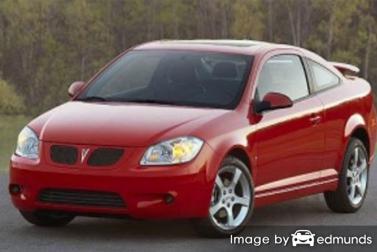

What Determines Pontiac G5 Insurance Premiums?

When buying insurance it’s important to understand the rating factors that go into determining the price you pay for insurance. If you know what influences your rates, this enables you to make decisions that can help you get lower insurance prices. Multiple criteria are used in the calculation when premium rates are determined. Most are fairly basic such as your driving history, although some other factors are not quite as obvious like where you live or your commute time.

- Use but don’t abuse your insurance – If you are a frequent claim filer, you shouldn’t be surprised to get higher premiums or even policy non-renewal. Insurance companies in Texas award the lowest premiums to people that do not abuse their auto insurance. Auto insurance is designed for claims that pose a financial burden.

- Insurance rates for married couples – Walking down the aisle helps lower the price on insurance. It means you’re less irresponsible and it’s statistically proven that married drivers get in fewer accidents.

- Responsible drivers have lower prices – Having a single speeding ticket may increase your cost by twenty percent. Good drivers get better prices than bad drivers. Drivers with careless violations such as DUI or willful reckless driving may face state-mandated requirements to complete a SR-22 with their state motor vehicle department in order to keep their license.

- Performance makes a difference – The type of vehicle you drive makes a huge difference in how high your rates are. Small economy passenger cars generally have the cheapest insurance rates, but there are many factors that impact the final cost.

- Lower rates for cars with good safety ratings – Safe vehicles are cheaper to insure. Highly rated vehicles reduce the chance of injuries and lower injury rates translates into fewer and smaller insurance claims and more competitive rates for policyholders. If your Pontiac scored at minimum an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website you may qualify for a discount.

- Liability coverage is peace of mind – The liability section of your policy is the coverage that protects you if you are determined to be liable for damages caused by your negligence. Liability provides you with a defense in court starting from day one. This coverage is very inexpensive when compared to the cost of physical damage coverage, so do not cut corners here.

- Decrease prices by maintaining coverage – Having a gap between insurance policy dates is a guaranteed way to increase your rates. Not only will rates go up, failure to provide proof of insurance will get you fines or a revoked license. Then you may be required to prove you have insurance by filing a SR-22 with the Texas motor vehicle department.

- Alarm systems save money – Choosing to buy a car with a theft deterrent system can get you a discount on your insurance. Theft prevention features like vehicle immobilizer systems, General Motors OnStar and LoJack tracking systems can help prevent vehicle theft.

When price shopping your coverage, quoting more will improve the odds of getting a lower rate. Some companies don’t provide online Corpus Christi G5 insurance quotes, so it’s necessary to compare prices on coverage from those companies, too.

The companies in the list below can provide price comparisons in Texas. In order to find the best car insurance in Corpus Christi, TX, we recommend you visit as many as you can to find the most affordable auto insurance rates.

Auto insurance protects more than just your car

Even though it’s not necessarily cheap to insure a Pontiac in Corpus Christi, maintaining insurance may be required for several reasons.

First, almost all states have minimum mandated liability insurance limits which means you are required to carry a specific minimum amount of liability coverage in order to license the vehicle. In Texas these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if you have a lien on your Pontiac G5, almost every bank will make it mandatory that you have full coverage to guarantee their interest in the vehicle. If you cancel or allow the policy to lapse, the lender may insure your Pontiac at a significantly higher premium and force you to reimburse them a much higher amount than you were paying before.

Third, insurance protects both your Pontiac and your personal assets. Insurance will also pay for all forms of medical expenses for not only you but also any passengers injured in an accident. Liability coverage also covers legal expenses in the event you are sued. If mother nature or an accident damages your car, your auto insurance policy will pay all costs to repair after the deductible has been paid.

The benefits of carrying enough insurance outweigh the cost, especially when you need to use it. As of last year, the average driver in Texas is currently overpaying as much as $750 every year so shop around each time the policy renews to save money.

Lower rates by qualifying for discounts

Some companies do not list their entire list of discounts very well, so the list below gives a summary of some of the more common as well as some of the hidden credits that you can use to lower your rates. If you do not double check each discount possible, you could be saving more on your auto insurance.

- Safety Restraint Discount – Buckling up and requiring all passengers to use their safety belts can save up to 15% off the personal injury premium cost.

- Good Grades Discount – A discount for being a good student may save you up to 25%. This discount can apply up until you turn 25.

- Renewal Discounts – Some companies provide a discount for switching companies prior to your current G5 insurance policy expiring. You can save around 10% with this discount.

- Telematics Data Discounts – Corpus Christi drivers who agree to allow driving data collection to track driving habits by using a small device installed in their vehicle such as State Farm’s In-Drive could save a few bucks if they show good driving skills.

- Drive Safe and Save – Safe drivers may save up to 50% more compared to rates paid by drivers with frequent claims.

- Military Rewards – Having a deployed family member may lower your premium rates slightly.

- Paper-free Discount – Some companies give back up to $50 for buying your policy online.

- Include Life Insurance and Save – Select auto insurance companies reward you with lower premium rates if you buy a life policy as well.

- Pay Early and Save – If paying your policy premium upfront instead of monthly or quarterly installments you could save 5% or more.

As is typical with insurance, many deductions do not apply to the entire cost. The majority will only reduce individual premiums such as comp or med pay. So when the math indicates adding up those discounts means a free policy, it just doesn’t work that way. But all discounts will reduce your policy cost.

To find insurers who offer discounts in Corpus Christi, follow this link.

Shop online but buy locally

A lot of people still like to sit down with an agent and that is OK! A good thing about getting online price quotes is you can get the lowest rates and still have a local agent.

Upon completion of this quick form, your insurance coverage information is immediately sent to insurance agents in Corpus Christi that give free quotes for your insurance coverage. There is no need to search for any insurance agencies because quoted prices will be sent to you instantly. It’s the lowest rates AND an agent nearby. If for some reason you want to get a price quote from a particular provider, just search and find their rate quote page and complete a quote there.

Upon completion of this quick form, your insurance coverage information is immediately sent to insurance agents in Corpus Christi that give free quotes for your insurance coverage. There is no need to search for any insurance agencies because quoted prices will be sent to you instantly. It’s the lowest rates AND an agent nearby. If for some reason you want to get a price quote from a particular provider, just search and find their rate quote page and complete a quote there.

Finding a good company requires more thought than just the premium amount. Any agent in Corpus Christi should be forthright in answering these questions:

- How long have they been in business?

- Will their companies depreciate repairs to your car based on the mileage?

- Can they provide you with a list of referrals?

- What companies can they write with?

- Will the company cover a rental car if your car is getting fixed?

- Are glass claims handled on-site or do you have to take your vehicle to a repair shop?

- Are there any extra charges for paying monthly?

- Does the company have a solid financial rating?

If you would like to find a good insurance agency, it can be helpful to understand the different types of agencies from which to choose. Agents are either exclusive or independent agents depending on their company appointments.

Exclusive Insurance Agencies

Agents that choose to be exclusive write business for a single company such as Farmers Insurance, Allstate, or State Farm. They are unable to give you multiple price quotes so you need to shop around if the rates are high. Exclusive agents are usually well trained on their company’s products and that allows them to sell at a higher price point. Some people will only choose to use a exclusive agent mostly because of high brand loyalty and solid financial strength.

Below are Corpus Christi exclusive agencies that are able to give price quotes.

- Allstate Insurance: Donald Morrison

4535 S Padre Island Dr Ste 37 – Corpus Christi, TX 78411 – (361) 854-2383 – View Map - Farmers Insurance – Jennifer Tennill

1145 Waldron Rd – Corpus Christi, TX 78418 – (361) 939-7300 – View Map - Jessica Kelly – State Farm Insurance Agent

5337 Yorktown Blvd #2b – Corpus Christi, TX 78413 – (361) 854-3225 – View Map

View more Corpus Christi agents

Independent Insurance Agents

These type of agents are not locked into one company so they can quote policies with a variety of different insurance companies and find the cheapest insurance rates. If you are not satisfied with one company, an independent agent can move your coverage and you don’t have to switch agencies. When comparing insurance prices, you will definitely want to check rates from independent agents to ensure the widest selection of prices. Many write coverage with small regional insurance companies which could offer lower prices.

Shown below are Corpus Christi independent agencies willing to provide rate quotes.

- Keetch and Associates Insurance

1718 Santa Fe St – Corpus Christi, TX 78404 – (361) 883-3803 – View Map - Trinity Insurance

4439 Gollihar Rd – Corpus Christi, TX 78411 – (361) 854-8600 – View Map - Star Advantage Insurance Agency

15201 S Padre Island Dr – Corpus Christi, TX 78418 – (361) 949-0396 – View Map

View more Corpus Christi agents

Once you have reasonable responses as well as offering an affordable quote, it’s possible that you found an auto insurance agent that is reliable enough to properly service your insurance policy.

There’s no such thing as the perfect car insurance policy

When it comes to buying coverage online or from an agent, there really is not a single plan that fits everyone. Your needs are not the same as everyone else’s.

For example, these questions might point out if your insurance needs may require specific advice.

- Does my policy cover me when driving someone else’s vehicle?

- What is GAP insurance?

- Does my policy pay for OEM or aftermarket parts?

- How much cheaper are high deductibles?

- I have a DUI can I still get coverage?

- Are combined or split liability limits better?

- Are there companies who specialize in insuring high-risk drivers?

- Why are teen drivers so expensive to add on to my policy?

If you don’t know the answers to these questions, you might consider talking to an insurance agent. If you want to speak to an agent in your area, simply complete this short form.

Cheap rates are available

Some companies may not have the ability to get quotes online and usually these small insurance companies sell through local independent agents. Budget-friendly insurance in Corpus Christi is possible on the web in addition to many Corpus Christi insurance agents, and you should compare price quotes from both to get a complete price analysis.

While you’re price shopping online, it’s very important that you do not skimp on coverage in order to save money. There are too many instances where an accident victim reduced full coverage only to find out that saving that couple of dollars actually costed them tens of thousands. Your focus should be to find the BEST coverage at the best cost, not the least amount of coverage.

People who switch companies do it for a number of reasons such as policy non-renewal, delays in responding to claim requests, poor customer service or even delays in paying claims. Whatever your reason, choosing a new insurance company can be pretty painless.

Additional information can be found at these links:

- What is a Telematics Device? (Allstate)

- Who Has Affordable Car Insurance for Low Income Drivers in Corpus Christi? (FAQ)

- Who Has the Cheapest Car Insurance for Single Moms in Corpus Christi? (FAQ)

- Who Has the Cheapest Auto Insurance Rates for Active Military in Corpus Christi? (FAQ)

- Understanding Car Crashes Video (iihs.org)

- Parking Tips to Reduce Door Dings (State Farm)